These questions reference the student who will be attending college during the 2022-2023 academic year. Spousal information is necessary in the case of married students if the student is married as of the day the FAFSA is being completed.

2020 tax information will be necessary to complete this section.

Always answer $0 if a question does not apply to you. Do not include cents. Round to the nearest dollar amount.

Student Tax Return Status:

Mark option "a" if you have an accurate current year tax return with all completed tax documents (i.e. W-2's, 1099's, K-1's, etc).

Mark option "b" if you are estimating your current year tax return or using a previous year's tax return. If you select this option you must update your FAFSA when you have a completed current year tax return.

Mark option "c" if no tax return will be filed.

It is encouraged to use the IRS data transfer option presented when filing the FAFSA online. It will be necessary to have a valid FSA ID username and password for the tax filer to access this information.You may apply for an FSA ID at fsaid.ed.gov. You will need to allow approximately 2-3 weeks from the electronic filing date of the federal tax return before the information will be available for the FAFSA. Additionally it may not be possible to utilize the IRS data retrievel depending upon the tax filing status of the student.

Tax Filing Status: Student's Tax Filing Status

Indicate your tax filing status for 2020. This can be found in the area below the address information on your federal tax return. This question relates to utilizing the IRS data retrieval tool to populate tax data to the FAFSA application. Filing options include:

- Single

- Head of Household

- Married, filing joint return

- Married, filing separate return (both parents still need to report information even when filing separately)

- Qualifying widow(er)

- Don't know

If you filed or will file a foreign tax return, IRS 1040NR or IRS 1040NR-EZ or a tax return with Puerto Rico, another US Territory (e.g. Guam, American Samoa, the US Virgin Islands, or the Northern Mariana Islands) or one of the Freely Associated States, use the information from that return to fill out this form.

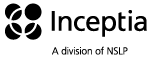

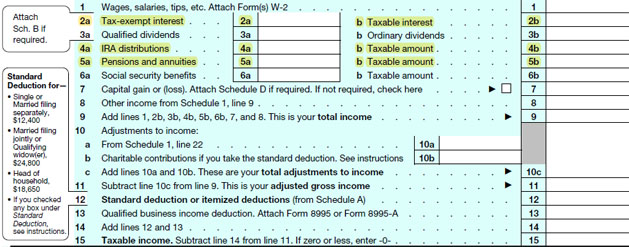

Student Adjusted Gross Income:

This information can be found on the following lines:

- Form 1040 - Line 11

Your adjusted gross income may or may not be the same as your wages from working. Numerous items are included in determining adjusted gross income so do not be concerned if this figure does not match your W-2 wages or self employment earnings.

If your adjusted gross income is negative you should list the amount as a negative.

1040 Example:

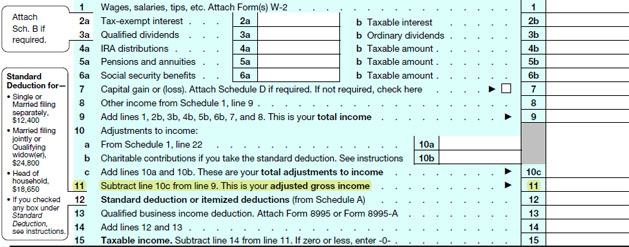

Student Earnings from Work:

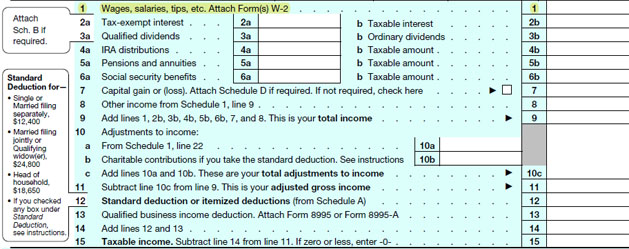

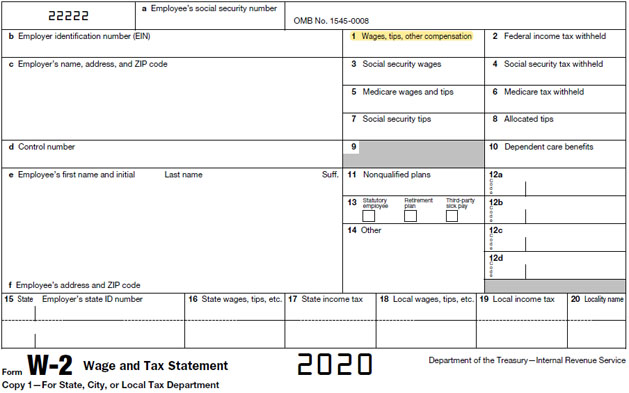

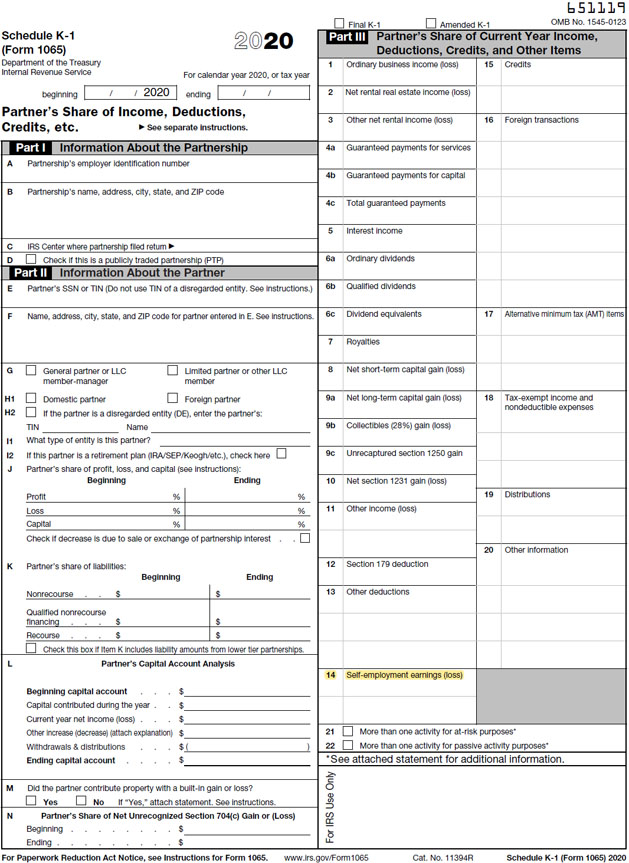

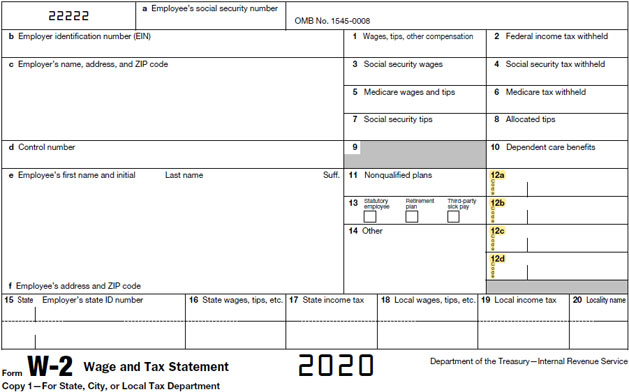

The FAFSA looks specifically at income earned from working. This information will be found primarily in Box 1 on a W-2 form. If you are self-employed, this information may appear on Schedule 1 Line 3 (for business) or Line 6 (for farm) or Box 14 (Code A) of IRS Schedule K-1 Form 1065 (for partnership).

Add W-2 wages, business income, farm income, and/or self employment earnings from your K-1 together if you earn income from all of these sources. If a business (Schedule C), farm (Schedule F) or partnership (K-1 Form 1065 Box 14 Code A) shows a loss, treat this negative figure as a $0 when determining earnings from work.

If you are married, be certain that you and your spouse each include your own individual earnings. Earnings for you and your spouse are counted if you are married as of the day you complete the FAFSA even if you were not married during the prior tax year or if you and your spouse filed separately. No spousal information is reported if you are single, divorced, separated, or widowed as of the date you complete this form.

You and your spouse need to report your earnings separately. Do not include all earnings under one person's income from work if both you and your spouse are working. You will only report a $0 under earnings from work for a student/spouse if that individual earns no income in their name or if self employment earnings are negative.

1040 Example:

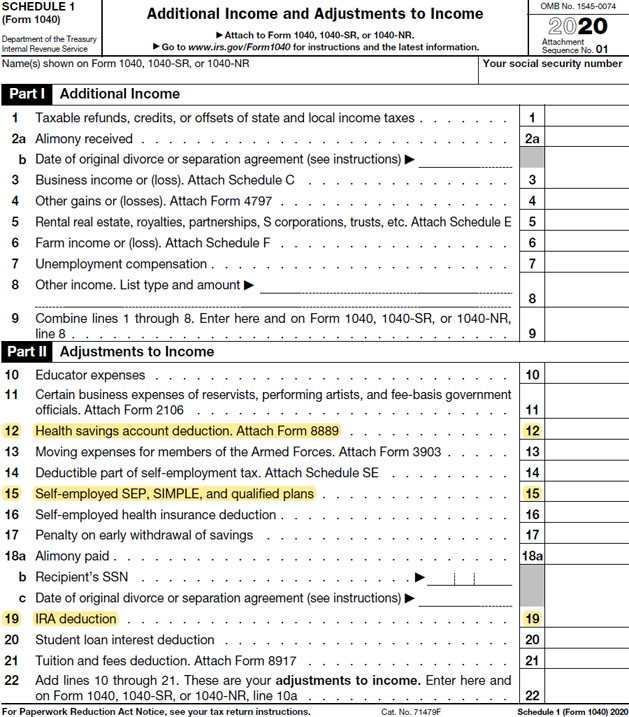

1040 Schedule 1 Example:

W2 Example:

Schedule K-1 Form 1065:

Form 1040 Tax Filers:

Did you file a Schedule 1 with your 2020 tax information? Generally, many people only need to file a 1040 with no schedules. Schedule 1 is used to report additional income or adjustments to income that cannot be listed directly on the Form 1040.

There are other reasons where a Schedule 1 is required. If you are uncertain as to whether you were required to file a Schedule 1, we advise you to contact your tax preparer.

Student Income Tax:

This information can be found on the following lines:

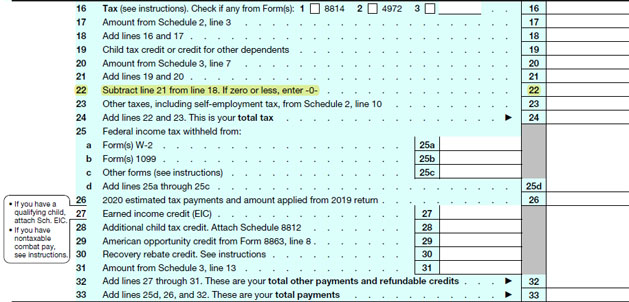

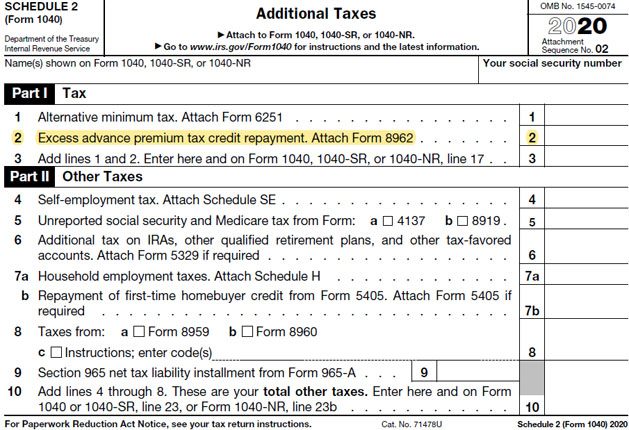

- Form 1040 - Line 22-Schedule 2 Line 2

Income tax is the amount of tax that you owe based upon your taxable income. Be certain you specify only the tax lines listed. This will NOT be the amount withheld on your W-2, your self-employment tax, your adjusted gross income, your refund amount or your tax balance due.

1040 Example:

1040 Schedule 2 Example:

Student Additional Financial Information:

Indicate a $0 if you do not receive these items. Report total amounts for calendar year 2020.

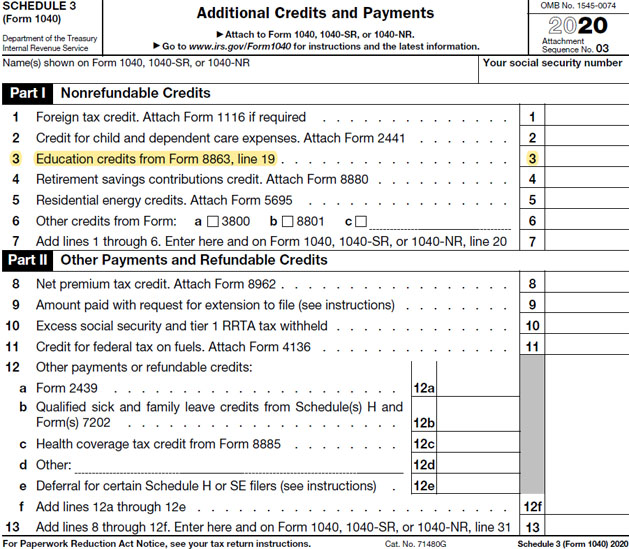

Report Education credits (American Opportunity, Hope and Lifetime Learning tax credits). These credits can be found on the following lines:

- Form 1040 - Schedule 3 Line 3

Report child support paid for all children living in another household. You will not report support for children who are living with you as reported in question 93. Report only the amounts actually paid if different than what is supposed to be paid. If you do not know your annual amounts contact your state's Health and Human Services Department.

Report earnings from a need-based employment program such as Federal Work-Study. Not all campus based employment is Federal Work-Study. Contact the Financial Aid Office at your institution if you are unsure. Also count earnings received via employment fellowships and assistantships.

Report grant and scholarship aid here ONLY if the amounts received exceeded the cost of tuition, fees, books, and supplies AND you reported this amount on your tax return.

Americorps benefits and grants or scholarship parts of fellowships and assistantships may also be reported if the earnings are counted on the tax return.Report combat pay or special combat pay only if it was taxable and included in your adjusted gross income.

Report earnings from work via a cooperative education program offered by a college. You will need to visit with the financial aid office at your college to determine the amount to be listed.

1040 Example:

Student Untaxed Income:

If none of these sources of untaxed income apply to you, indicate a $0. Report total amounts for calendar year 2020.

- You must report pre-tax contributions to retirement accounts such as a 401(k). Do not report the value of the retirement plan, only the pre-tax contributions reported on your W-2. You do not need to report employer contributions, employer matching amounts, or after tax contributions. These amounts may be reported on your W-2 form in boxes 12a - 12d, codes D,E,F,G,H and S. Do not report pre-tax contributions to cafeteria plans, health flex accounts, dependent care expenses or insurance plans. An example appears below.

Report untaxed contributions to traditional IRA's and/or self-employed SEP, SIMPLE, or KEOGH plans. Contributions have already been taxed for Roth IRA's and are therefore not reported here. This information can be found on the following lines:

- Form 1040 - Schedule 1 Line 15 and Line 19 (If you have figures on both of these lines, add them together and report the total).

Report the amount of child support received for all members of the household including children other than you. Report only the amounts actually received, not what should have been received. Child support received for you should be reported in this question only if the money is paid directly to you. If the payments are received by your parent the amounts should be reported in parent question 92. If you do not know your annual amounts contact your state Health and Human Services office. Do not include foster care or adoption payments.

Report only tax EXEMPT interest income. Taxable interest from bank accounts and other standard savings vehicles are NOT listed. The tax exempt interest information can be found on the following lines:

- Form 1040 - Line 2a

Report only untaxed portions of distributions from your IRA and pensions. Do not include direct rollovers of any retirement or pension plans. This information can be found on the following lines:

- Form 1040 - Line 4a minus 4b or 5a minus 5b

- If the figure is negative, report $0.

Report housing, food and other living allowances that are a part of an employee's compensation package. The most common situation is a member of the clergy although anyone receiving a housing benefit as a part of their compensation will include it here. These amounts may or may not be listed on your W-2 form. Clergy may locate a housing allowance in Box 14 of the W-2. If the amount is not reported on your W-2 refer to your employment contract or ask your employer. Do not include the value of on-base military housing or the basic military allowance for housing.

Report the amount of Veterans' non-education benefits received for all members of the household including children other than you. Veterans' non-education benefits received for you should be reported in this question only if the money is received in your name. If the payments are received in the parent's name the amount should be reported in parent question 92. If you do not know your annual benefit amounts contact the VA's toll free number at 800-827-1000 or visit the VA Web site at www.va.gov.

Other untaxed income includes amounts received in the previous calendar year for the following items:

- Health Savings Account deduction on Schedule 1 Line 12

- Worker's compensation

- Untaxed portions of health savings accounts from Schedule 1 Line 25

- Untaxed railroad retirement benefits

- Private disability income that is not taxed (sources other than social security)

- Any additional untaxed resources or benefits

You will NOT count financial aid received, earned income credit, additional child tax credit, welfare payments, untaxed Social Security benefits (including Supplemental Security Income (SSI), Workforce Investment Act benefits, combat pay, benefits from flexible spending arrangements (eg. cafeteria plans), foreign income exclusion or credit for federal tax on special fuels.

Money reported in this item will include cash given to you or bills that are paid for you. You will not count food or housing that you receive in exchange for work or services unless this allowance is considered a part of your compensation package (see housing and living allowances reported above).

If you are living with someone (friend, significant other, grandparents, other relatives) who are supporting you with money or paying your bills you will need to determine the amount you received in this support during the calendar year and report this as untaxed income.

If you receive a distribution from a 529 plan that is owned by someone other than you or your custodial parent (such as your non-custodial parent, grandparents, aunts or uncles) you must list this distribution amount here.

1040 Example:

1040 Schedule 1 Example:

W2 Example:

W2 CODES:

B - Uncollected Medicare tax on tips. Include this tax on Form 1040. See "Total Tax" in the Form 1040 instructions.

C - Taxable cost of group-term insurance over $50,000 (included in boxes 1,3 (up to social security wage base), and 5)

D - Elective deferrals to a section 401(k) cash or deferred arrangement. Also includes deferrals under a SIMPLE retirement account that is part of a section 401(k) arrangement.

E - Elective deferrals under a section 403(b) salary reduction agreement.

F - Elective deferrals under a section 408(k)(6)salary reduction SEP

G - Elective deferrals and employer contributions (including nonelective deferrals) to a section 457(b) deferred compensation plan

H - Elective deferrals to a section 501(c)(18)(D) tax-exempt organization plan. See "Adjusted Gross Income" in the Form 1040 instructions for how to deduct.

J - Nontaxable sick pay (information only, not included in boxes 1,3, or 5)

K - 20% excise tax on excess golden parachute payments. See "Total Tax" in the form 1040 instructions.

L - Substantiated employee business expense reimbursements (nontaxable)

M - Uncollected social security or RRTA tax on taxable cost of group-term life insurance over $50,000 (former employees only). See "Total Tax" in the Form 1040 instructions.

N - Uncollected Medicare tax on taxable cost of group-term life insurance over $50,000 (former employees only). See "Total Tax" in the Form 1040 instructions.

P - Excludable moving expense reimbursements paid directly to employee (not included in boxes 1,3, or 5)

Q - Nontaxable combat pay. See the instructions for Form 1040 or Form 1040A for details on reporting this amount.

R - Employer contributions to your Archer MSA. Report on Form 8853, Archer MSAs and Long-Term Care Insurance Contracts.

S - Employee salary reduction contributions under a sections 408(p) SIMPLE (not included in box 1)

T - Adoption benefits (not included in box 1). You must complete Form 8839, Qualified Adoption Expenses, to compute any taxable and nontaxable amounts.

V - Income from exercise on nonstatutory stock option(s) (included in boxes 1, 3 (up to social security wage base), and 5)

W - Employer contributions to your Health Savings Account. Report on Form 8889, Health Savings Accounts (HSAs).

Y - Deferrals under a section 409A nonqualified deferred compensation plan.

Z - Income under section 409A on a nonqualified deferred compensation plan. This amount is also included in box 1. It is subject to an additional 20% tax plus interest. See "Total Tax" in the Form 1040 instructions.

AA - Designated Roth contributions to a section 401(k) plan.

BB - Designated Roth contributions under a section 403(b) salary reduction agreement.

Student Federal Benefits Programs:

Mark the oval for the appropriate federal benefits program if benefits were received in 2020 or 2021 by the student, your spouse, or anyone else in your household. You may mark more than one program. These programs include:

- Supplemental Security Income (SSI)

- Supplemental Nutrition Assistance Program (SNAP)

- Free or Reduced Price Lunch

- Temporary Assistance for Needy Families (TANF)

- Medicaid

- Special Supplemental Nutrition Program for Women, Infants and Children (WIC)

Student Checking/Savings Balance:

This question refers only to personal checking accounts, savings accounts, and cash on hand as of the day you complete the form. Do not include leftover student financial aid that you have in these accounts.

Student Investments:

Investments include stocks, savings bonds, mutual funds, CD's, money market accounts, UGMA and UTMA accounts, rental property (including a rental unit within a family home if it has its own entrance and kitchen and is rented to someone other than a family member), a second residence, commodities, trust funds, stock options, securities, qualified education benefits, education savings accounts as well as installment and land sale contracts.

DO NOT include your primary home, any retirement accounts (IRA, 401(k), annuities), the cash value of life insurance policies, UGMA and UTMA accounts where you are the custodian but not the owner, or amounts reported in Question 41.

Qualified educational benefits or education savings accounts include:

- Coverdell Savings Account

- 529 college savings plans

- the refund value of 529 state prepaid tuition plan

If any of these accounts are owned by a dependent student (a student who is required to report parental information), the value of each of these accounts is reported as a parental asset in question 91. If any of these accounts are owned in a parent's name, these will be reported on the FAFSA in question 91. This may include college savings plans with other children as beneficiaries. If someone other than the student's parent is the owner of the College Savings Plan then this amount should not be listed on the FAFSA. If any of these accounts are owned by an independent student (a student who is not required to report parental information) or the student's spouse, the value of the account is reported as an asset here.

The value of an investment will be listed as of the day you are completing the FAFSA application. You will list the current market value of the investment on that date. For example, if you own a savings bond with a face value of $1,000 that was purchased last year you will want to determine its actual worth as of today's date. You may use this link to determine a current value http://www.treasurydirect.gov/BC/SBCPrice.

Net worth should be reported. If an investment is specifically held as collateral for a debt, this debt may be subtracted from the value of the investment. For example, if you own a rental home worth $60,000 but you owe $30,000 against it you will report $30,000 as the net worth of that property.

If the net worth is negative, enter $0.Student Business/Farm Value:

Business

For purposes of the FAFSA, a business is an entity other than a farm.

You will exclude the value of a small business where your family owns and controls over 50% interest and has fewer than 100 full time or full time equivalent employees. Your family can include yourself, your spouse, your parents or stepparents, siblings, or other family members directly related to you (i.e. cousins) or related by marriage (i.e. brothers or sisters in law)

If your business does not meet this definition, the business value will include the value of all assets tied to your business - land, buildings, inventory, equipment, "blue sky" value, etc. Your value should consist of what these items would be worth if you were to sell them and should reflect what you would ask for your business if you decided today that you would liquidate your business. You will subtract any debt that is held specifically against the business which would reduce the amount you received upon the sale of the business.The net worth of the business is what you would end up with after you sold all business assets and subtracted any debt still owed against the business. In other words, the net worth is your equity stake in your business.

Investment Farm

If you live on your farm, own your farm and actively participate in its operation you will list a $0 for the net worth of your investment farm (this includes the value of land, equipment, livestock, grains in storage, and outbuildings). Your assets will not be counted nor will your debt.

If you rent farm ground out to someone else to farm for you this WILL be considered an investment farm. If you receive pasture rent from another individual, you will need to determine the net worth of the pasture land as an asset. Also if you are a shareholder or own a partnership interest in a family farm that you do not actively participate in farming this WILL be considered an investment farm. In this case you will determine the value of land, buildings, inventory, machinery, livestock, grains in storage, etc. that you would sell if you decided to sell your interest in the farm. You may also subtract debt against these items. You will only report your percentage ownership in the farming entity. For example, if you own 100 shares in a corporation then you will count only the net worth of your 100 shares. If your partnership interest is 30% you will count only 30% of the total net worth of the farm partnership.

This may be a confusing question so you are welcome to contact your college financial aid office for further guidance.

Student is a Dislocated Worker:

A dislocated worker meets one of the following criteria:

- You have lost your job

- You have been laid off or received a lay-off notice from your job

- You are receiving unemployment benefits due to a lay off or loss of employment and you are unlikely to return to your previous occupation

- You are self-employed but are unemployed due to economic conditions or natural disaster

- You are a displaced homemaker which means that you have been providing unpaid services to your family (e.g. stay at home parent), you are no longer being supported by your spouse, you are unemployed or underemployed, and you are having trouble finding or upgrading employment

Student Household Information:

Household members are those individuals you are providing more than 50% of the support for. They include you, your spouse, your children living with you, and other people if you provide more than 50% of their support. This support must occur currently and continue to occur in the upcoming school year.

An unborn child may also be included in the household size as long as you will provide more than 50% of their support after birth.

The household size may not necessarily be the same as the exemptions you claim on your tax return.

Include as college students yourself and any other students in the household enrolled in college on at least a part time basis.

Required Signatures:

All students are required to sign the FAFSA. If parent information was reported on the FAFSA one parent is also required to sign the form. You will either use your FSA ID username and password to provide your signature or print out a signature page to sign and mail in if you are filing electronically. Your parent will need to use the paper signature page if they do not have a social security number. Having FSA ID's will speed up processing of your application.

If you are completing a Paper FAFSA, be sure you sign and date the form.

If you do not have an FSA ID username and password you can apply for one at fsaid.ed.gov. You will need an FSA ID in the student's name and one in a parent's name if parent information is reported on the FAFSA.